VTMarkets Review

Overview

CIMA – Cayman Islands Monetary Authority

ASIC – Australian Securities and Investments Commission

- Islamic Account Offered

- MT4 And MT5 Available

- Bonuses Available

- ZuluTrading Featured

- Needs More Research Tools

- No US Traders

Overview

VT Markets, based in Sydney, Australia, is a subsidiary of Vantage International Group Limited (VIG) and leverages more than 10 years of experience and expertise in global financial markets to offer easy and transparent market access and help our clients pursue their financial goals. VT Markets is perpose to offering “easy and transparent” access to global markets.

Trading products at VT Markets

VT Markets offers traders a portfolio that includes the most commonly traded products in the market such as forex, metals, indices, commodities and stocks.

- Forex: 37 currency pairs, including majors, crosses and exotics.

- Metals: including gold (XAU.USD) and silver (XAG.USD)

- Commodities: including energy (natural gas, gasoline, crude oil) and soft commodities (cocoa, cotton, coffee, orange juice, raw sugar)

- Indices: 16 stock indexes, representing major markets in the world such as the US, Asian markets and European countries.

- Stocks: offers 50 stocks listed on the US stock exchange and 50 major stocks representing the Hong Kong stock market.

Trading Platform

MT4 and MT5 Platforms

VT Markets supports providing its customers with both the two most popular trading platforms today, MT4 and MT5. Both are products of MetaQuotes, a world famous software development company. MT4 was born first, providing almost all features to support trading from basic to advanced, suitable for all types of traders. MT5 was born later, added a number of more advanced features, to meet the trading needs of the most demanding traders, especially MT5 was developed with a direct share trading feature for traders. invest.

Some features of the MT4 platform:

- 3 types of price charts and 9 timeframes

- 4 types of pending orders

- More than 50 technical indicators and drawing tools for chart analysis

- One-click trading feature

- Allow scalping, hedging

- Allows the use of EAs and the ability to backtest single-threaded strategies

- Provide daily economic news directly on the platform

- To use all services and features of the mql5.com platform

- There are software versions for computers, applications on phones, tablets and online web platforms

In addition to the features available on MT4, MT5 introduce with some additional features such as:

- 21 time frames

- 6 types of pending orders

- More than 80 technical indicators and drawing tools for chart analysis

- Allows the use of EAs and the ability to backtest multi-threaded strategies

- Provide an Economic Calendar directly on the platform

- Live stock trading

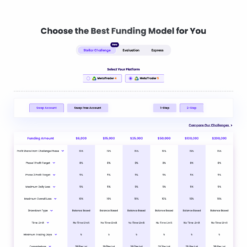

Trading account at VT Markets

With VT Markets, investors can trade on 2 different account types, for 2 different types of traders, including a standard account – Standard STP and an ECN account – Raw ECN.

Standard STP . Account

It is the choice of most new traders, after having experienced on a Demo account and ready to trade in the real market. The Standard STP account is offered with the trading conditions of the most standard account type on the market, with spreads from 1.2 pips and a “no commission” policy. VT Markets works with a lot of major liquidity providers to ensure this account is provided with the best, most competitive quotes and the processing speed on this account is also very fast, 100 GB/s, thanks Equinix fiber optic network.

Raw ECN account

If you are looking for an ECN account at a reputable broker, the VT Markets Raw ECN account is a good choice. This account is preferred by most of the seasoned, professional traders. Spreads from only 0.0 pips are a powerful weapon that helps them save costs when trading large volumes.

Compare trading conditions on 2 types of VT Markets accounts

Leverage and Trading Fees

Lever

Leverage is a great tool for traders to maximize profits on small capital, but don't forget that leverage is always associated with risk, the larger the leverage, the higher the risk.

At VT Markets, you can trade with a maximum leverage of 1:500, this rate is applied on both Standard STP and Raw ECN account types, but it is the maximum rate when trading on Different currency pairs and asset classes will have different maximum leverage levels. Specifically:

- Forex is 1:500

- Index is 1:200

- Crude oils are 1:500

- Natural gas and gasoline are 1:20

- Gold is 1:500, silver is 1:100

- Soft goods (agricultural products) is 1:20

- Stock is 1:20

Transaction fees

Regarding spreads, both account types of VT Markets have low spreads, which can compete with accounts of the same type of other reputable brokers in the market.

The Standard STP account has a spread of only 1.2 pips on the EUR.USD pair and is subject to a commission-free policy, which is a good cost, almost similar to most standard account types on reputable exchanges today. like Exness or IC Markets…

Raw ECN accounts have extremely low spreads, from only 0.0 pips, the commission of $7/lot/2 way is also a fee that brokers are applying on their ECN account type.

About commission fee

The commission is only applicable on ECN accounts and only for forex and stock transactions. Commission for forex trading is 7$/lot/2 way and for stocks is 6$/trade (US shares) or 50HKD/trade (Hong Kong shares).

Payment Methods

VT Markets is said to be quite diverse in terms of deposit and withdrawal because it supports many different payment gateways for customers to freely choose, currently the following are payment gateways that you can choose from. Use at floor:

- Visa/Mastercard

- Internet Banking

- Wire transfer

- UnionPay

- MobilePay

- FasaPay

- Neteller

- Skrill

In addition, the deposit and withdrawal orders you use at the exchange will be processed extremely quickly and with absolutely no surcharge, so this can be considered a strong point of VT Markets compared to other exchanges. same time. Note that for withdrawal orders, you should book before 9:00 GMT to optimize the processing time of the day.

Customer Support

VT Markets is backed by a responsive team of customer support executives available 24/5 via email. VT Markets active clients can also take advantage of a live chat for advanced technical support on their desktop and mobile trading platforms. In addition to this, customers can also find a “Help Centre” on the official portal of the broker, where all the trading-related concepts are discussed.

Conclusion

Overall, VT Markets is an excellent broker, suitable for both, beginners and experienced traders. It is heavily regulated, and it has features like Islamic accounts and MetaTrader 4 and 5 on offer. Featuring the latest educational tools, it still is an excellent choice for anyone looking to trade a wide range of markets.

FAQ

Lower fees, lower costs?

We detailed this in our VT Markets fees article.

What about the minimum deposit?

VT Markets minimum deposit is update regularly.

How to start your VT Markets account?

Look no further than our evaluation of the VT Markets account opening.

How's their trading app?

Here's our expert view after checking the VT Markets trading app.

Is the quality of customer service satisfactory?

All you need to know about the VT Markets customer service.