ThinkMarkets Review

Overview

FCA, ASIC, FSCA, CySEC, JFSA, FSA Seychelles

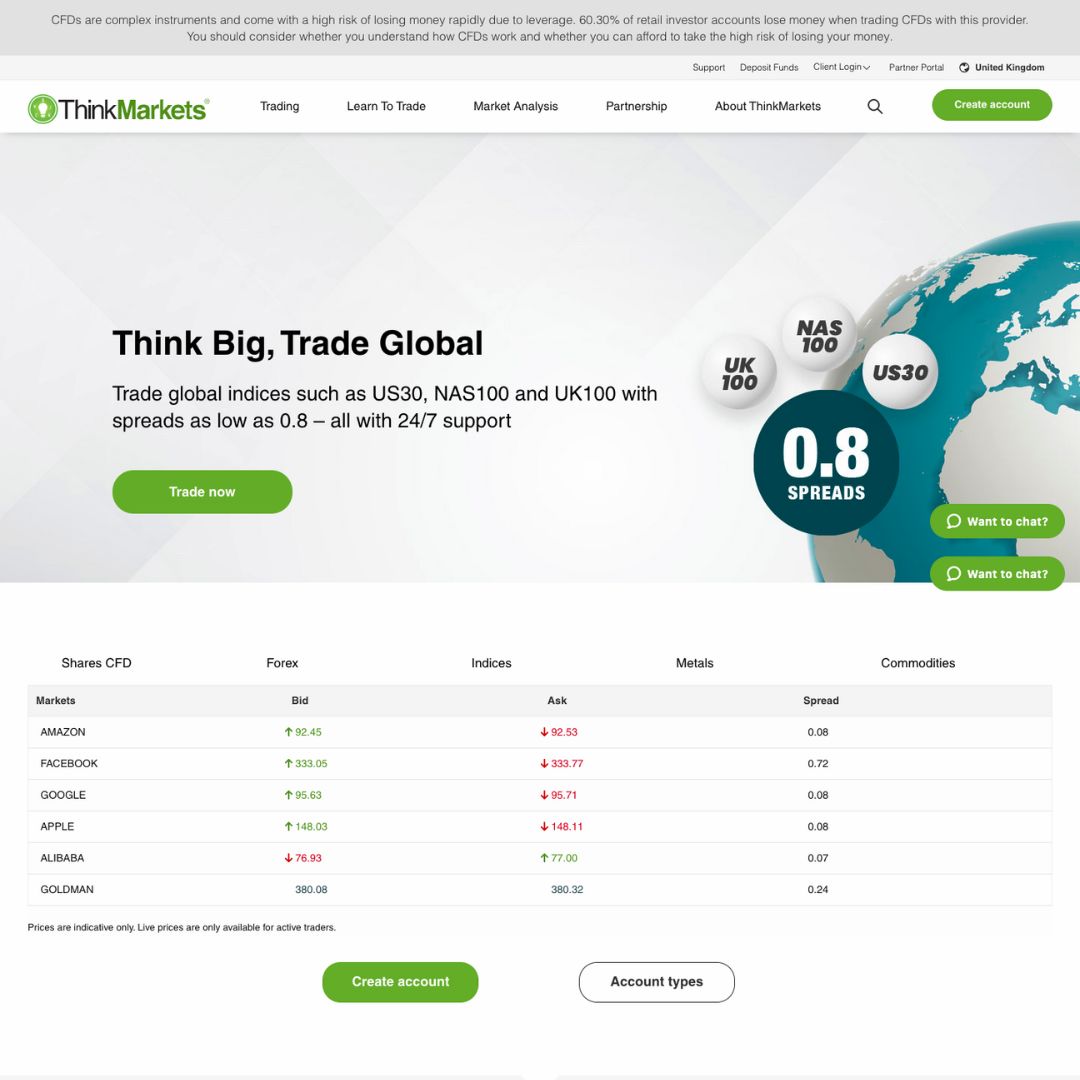

ThinkMarkets is a multi-regulated broker offering trading in forex and CFDs. Users can choose between MT4 and MT5, plus the broker’s ThinkTrader platform. This, along with low trading fees and over 3500 instruments makes the ThinkMarkets group an attractive proposition.

Our review will unpack the login process, client portal features, and more.

71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ThinkMarkets Overview

ThinkMarkets was founded in 2010 by CEO – Nauman Anees. The group has headquarters in Melbourne and London and forms part of Think Capital Limited, a company registered in Bermuda.

Since 2010, the online broker has expanded its trading operations, attracting 550,000 users in 180 countries, including Indonesia, Egypt, the UAE, and Bulgaria. In 2018 ThinkMarkets made the news for allowing Australian investors to invest in an emerging financial technology market with a £100 million initial public offering (IPO) on the ASX.

The broker is regulated by the Australian Securities & Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), South Africa’s Financial Services Conduct Authority (FSCA) and the Financial Services Authority (FSA) Seychelles.

Additionally, the broker has obtained two additional regulatory licenses; the Cyprus Securities and Exchange Commission (CySEC) in Europe as well as the Japanese Financial Services Agency (JFSA).

Trading Platforms

Three trading platforms are available; the broker’s own ThinkTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

ThinkTrader

The broker’s proprietary ThinkTrader platform is slick and intuitive. Users get over 125 indicators, 50 drawing tools, plus 20 different chart types. Clients also benefit from close to 200 free cloud-based notifications. Direct chart trading is also available, along with standard risk management tools and multiple order types.

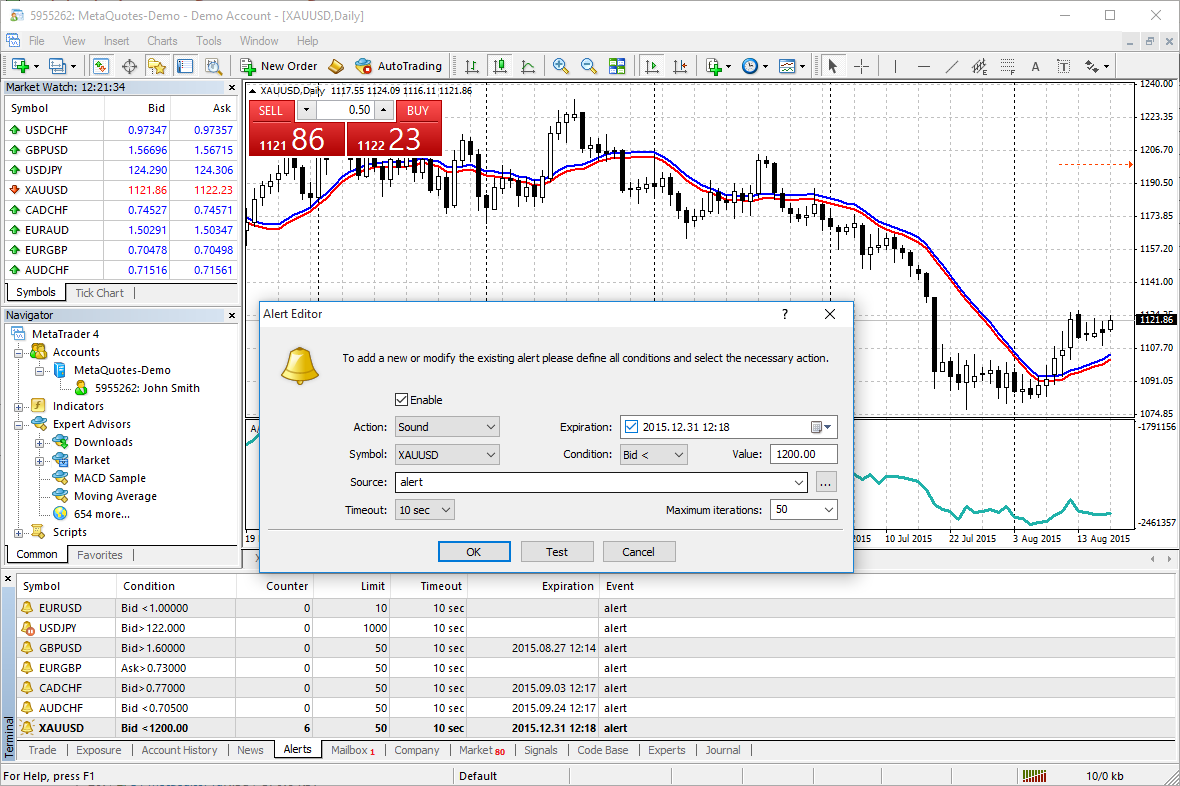

MetaTrader 4

The MT4 platform can be downloaded to your PC free of charge. The platform promises fast trade execution, over 100 indicators, and one-click-trading. The MT4 system also comes with a host of superb apps and additional features, including free access to Trading Central, a VPS, and FXWirePro.

MetaTrader 5

The MT5 platform is the latest version of the popular MT4 software. It appeals to seasoned traders, in particular, offering more advanced trading tools and analysis features. Users benefit from additional technical indicators and timeframes, plus an enhanced strategy tester for EAs, as well as a built-in economic calendar.

Platform Options:

- MT4: Mobile (Android, iOS, iPad), MT4 Web, MT4 Desktop download for Windows and Mac.

- MT5: Mobile (Android, iOS, iPad), MT5 Web, MT5 Desktop download for Windows.

- ThinkTrader: Mobile, Tablet, Desktop, ThinkTrader Web.

Markets

ThinkMarkets has a 3500+ list of tradable instruments, covering:

- Forex – 46 majors, minors, and exotics

- Stocks – 3500+ shares & ETFs available

- Indices – 15+ global indices

- Commodities – Oil, gas, & agricultural

- Precious metals – Gold, silver, platinum & copper

- Cryptocurrencies – 20+ including Bitcoin, Ethereum, Dash & more

(As per regulation Crypto CFDs are not offered to retail traders in the UK) - Futures – 10+ including BRENT, WTI and COTTON

Spread betting is also available for UK clients only.

Spreads & Commissions

ThinkMarkets scored highly in terms of trading fees. Spreads are variable and start from zero pips on major FX pairs, such as the EUR/USD and GBP/USD.

With the ThinkZero spread account, there is a $3.5 commission per side of 100,000 (£2.5 units per side in the UK). This commission applies to FX and Metals only and ThinkZero accounts are available on MetaTrader 4 and MetaTrader 5 platforms.

ThinkMarkets reserve the right to charge an inactivity fee.

Traders will be pleased to see there are no swap rates.

Leverage

The maximum leverage available depends upon the type of account (retail /professional) and the ThinkMarkets entity.

- Forex – leverage up to 1:500

- Indices – leverage up to 1:200

- Commodities – leverage up to 1:200

- Cryptocurrency – leverage up to 1:10

To avoid a margin call, make sure you have enough capital in your account.

Note, due to regulations, the maximum leverage available to traders from Europe, the UK and Australia is 1:30.

Mobile App

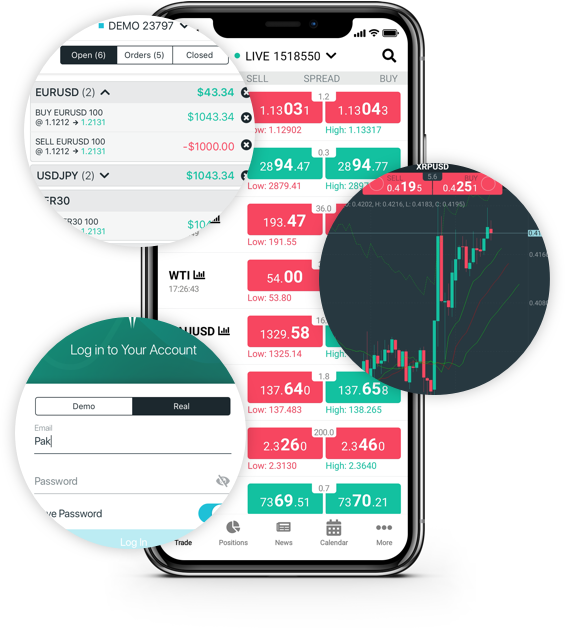

ThinkMarkets offer a full-service mobile app called ThinkTrader, which is available to download for iOS and Android devices. Previously Trade Interceptor, ThinkMarkets has enhanced the platform to provide a superior mobile trading experience. The app has since been rated five stars by over 15,000 users.

The award-winning mobile program offers thousands of markets, in-app chat support, plus a breadth of analysis tools and technical indicators.

Payment Methods

Funding your account is available via several deposit methods (which may vary depending on the client’s country of residence and the ThinkMarkets entity):

- Bank transfer – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: 1 – 3 business days

- Credit & debit card – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: instant

- Skrill – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: up to 10 minutes

- Neteller – available currencies: AUD, GBP, USD, JPY, EUR. Estimated processing time: up to 10 minutes

- Bitpay – Available currencies; Bitcoin, Ethereum and Bitcoin Cash. Estimated processing time: up to 10 minutes

There is no minimum deposit with the Standard account, but the ThinkZero account requires a minimum deposit of $/£500.

For security reasons, the withdrawal and deposit method must be the same. Withdrawals are normally processed within 24 hours but may take up to seven working days. For withdrawals via bank transfer, the minimum withdrawal amount is $/£100. There are no deposit or withdrawal fees at ThinkMarkets.

Demo Account

ThinkMarkets offers a demo account with $/£25,000 in practice cash. Users can refine strategies and test the MT4, MT5, and ThinkTrader platforms while getting familiar with the available instruments.

Demo accounts on MT4/MT5 will expire after 90 days of inactivity and demo accounts on the ThinkTrader platform do not expire but ThinkMarkets do reserve the right to close them.

Welcome Bonus & Promotions

ThinkMarkets do not currently have any active promotions or offers.

Regulation & Licensing

TF Global Markets UK Ltd is FCA registered while the group also holds licenses with the Australian Securities & Investments Commission (ASIC), South Africa’s Financial Services Conduct Authority (FSCA), Cyprus Securities and Exchange Commission (CySEC), Japan’s Financial Services Agency (JFSA) and the Financial Services Authority (FSA) Seychelles.

The broker offers negative balance protection to stop clients from losing more than their deposits. Also, ThinkMarkets has a £1 million insurance protection plan.

Overall, we’re satisfied the broker is highly regulated and trustworthy.

Additional Features

ThinkMarkets has a pretty good library of educational resources. For beginners, there are free video tutorials and a trading glossary. Tutorials aimed at intermediate and advanced traders are also available. Additionally, trend PDFs, market news, and blogs from industry experts can be found on the broker’s website.

The multitude of tools are all designed to help traders boost revenue and minimise losses.

Account Types

ThinkMarkets has two popular retail accounts:

- Standard account – Average FX spread is 1.2 pips, no commission or minimum deposit, and maximum trade size is 50 lots. The Standard account has VPS access available via MT4 and MT5 but no access to an account manager.

- ThinkZero – Average FX spread is 0.1 pips, $3.5 / £2.5 unit commission per side, $/£500 minimum deposit, and maximum trade size is 100 lots. ThinkZero is best suited to traders looking for zero spreads and large position sizes.

Islamic trading accounts and joint accounts are also available.

Note the broker does not use an ECN model and is primarily a market maker.

Benefits

ThinkMarkets scores highly in broker rankings for several reasons:

- 3500+ tradable products

- Award-winning customer support, available 24/7

- Choice of platforms, including MT4 & MT5 and the highly rated ThinkTrader platform (also available as a web terminal)

- Licensed by top tier regulators in both Australia (ASIC) & UK (FCA)

- Quick & easy to open a ThinkMarkets account

- Copy trading via Zulutrade

Drawbacks

Downsides to trading with ThinkMarkets include:

- No binary options

Trading Hours

ThinkMarkets trading hours follow standard opening and closing times of respective markets. So, for forex and indices, most trading will take place Monday to Friday. Contract specific opening hours can be found on the broker’s website.

Customer Support

ThinkMarkets multilingual customer support team is available 24/7. They can be contacted through:

- Email – support@thinkmarkets.com

- Telephone – UK: +44 203 514 2374, AUS: +61 3 9093 3400 Italy: +39 023 057 9033, Spain: +34-911829975, South Africa: +27 10 446 5933

- Live chat – chat support available on the website and mobile app

A self-service FAQ client portal and online query form are also available on the broker’s website.

Use ThinkMarkets social media channels to keep up to date with the latest product and promotional news:

ThinkMarkets have global offices in London, Chicago, Melbourne and South Africa.

Security

The ThinkMarkets website is secured using industry-standard encryption protocols. Also, the MetaTrader platforms use a one-time-password to provide an additional layer of security.

ThinkMarkets Verdict

ThinkMarkets is an excellent forex and CFD broker. A choice of trading platforms, thousands of instruments, and low fees make the group suitable for beginners and veterans. The broker is also highly regulated with a long list of positive reviews from customers worldwide.

Accepted Countries

ThinkMarkets accepts traders from Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use ThinkMarkets from United States, Canada, Belgium, Russian Federation.