IQCent

Overview

IQCent offers 100+ assets spanning forex, CFDs, cryptos, and binary options. The online broker aims to support novices and experienced traders alike through its proprietary trading platform with a range of technical and fundamental analysis tools. This 2022 review of IQCent unpacks the firm’s investing apps, supported trading strategies, demo accounts, and promo codes. Find out whether you should open a trading account with IQCent.

Company Details

IQCent is a multi-asset trading brokerage with headquarters in the Marshall Islands. Launched in 2017, the retail trading brand is run by Wave Makers Ltd, which also operates BinaryCent, another popular options broker.

IQCent offers 24/7 trading with a $250 minimum deposit and a $0.01 minimum trade size, making it popular with beginners. The broker also boasts payouts of 95% on its binary options products while 10+ payment methods can be used to fund live accounts.

The trading brand accepts clients from many countries around the world, including Canada, India, Japan, South Africa and the UK. The broker is not available to investors based in the USA.

Note, IQCent is an unregulated trading broker.

Markets & Products

Clients can speculate on the broker’s 100+ financial instruments using straightforward binary options contracts and leveraged CFDs:

- Forex: 40 major, minor and exotic currency pairs

- Stocks: Four German stocks: Lufthansa, Deutsche, Daimler and BMW

- Cryptocurrency: 17 cryptos including Bitcoin, Ethereum and Litecoin

- Commodities: Four commodities: gold, silver, copper and brent crude oil

- Indices: Seven indices including the US30, S&P500 and FTSE100 (only available as CFDs)

Trading Platforms

IQCent provides its own trading platform. There is no option to use third-party platforms.

Executing A Trade

To make a trade on the IQCent platform, you must first choose whether you are opening a CFD position or utilizing an options contract.

CFDs

Input the trade size and select whether you want to go long or short. The maximum leverage offered is 1:500 and the platform will tell you the required stake to open the trade. You can trade in either dollars or cents, and the minimum trade size is $0.01.

You also have the option to include stop-loss and take-profit orders, which can be used to automatically close a position when certain price conditions are met, thus reducing risk exposure.

Additionally, IQCent allows clients to choose whether the contract opens at the current market price or on the condition of a security reaching a certain value. For instance, brent crude oil is currently trading at $93. You can set an ‘IF’ contract such that if brent declines to $92, an order will automatically be placed.

Note that for CFD contracts there is a maintenance margin of 5%, meaning the maximum loss you can make on your positions before IQCent closes your contract is 95%. Ensure the net balance in your account can always cover the minimum required margin if you do not want positions to be automatically closed.

Options

When you open a binary options contract, you must first select the expiry. Unless you use a rollover, this is a fixed expiration time. For this, you can choose between a turbo (1 minute to 30 minutes), intraday (specify to a given hour), or long-term (specific date).

The only type of binary option you can open is high/low with the strike price set at the current market value. There is a bar on the left-hand side of the chart showing the percentage profit for either a high or low binary option, indicating your expected payout should you open the contract.

Finally, you input your stake and select call or put to begin the trade.

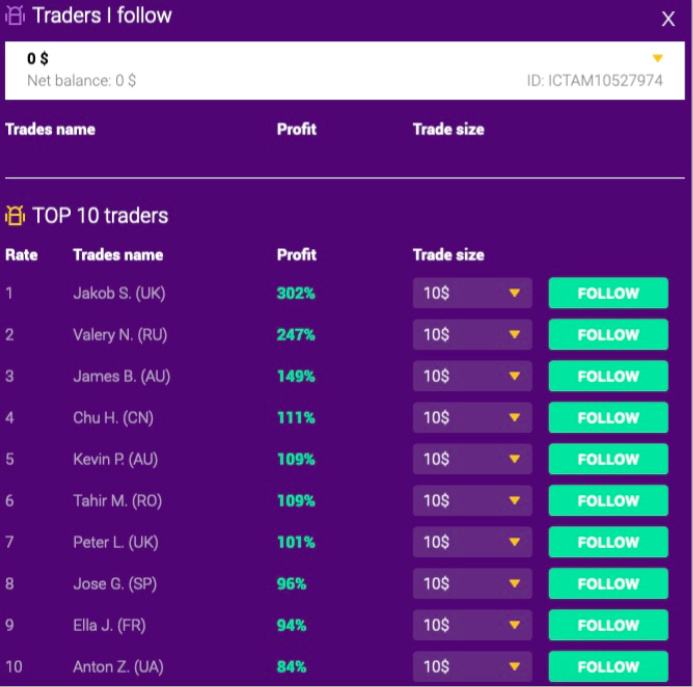

Copy Trading

IQCent also offers a copy trading service such that clients can follow and replicate the trades of selected investors. The copy trading tool can be accessed via the main platform where you can see a leaderboard of the top 10 most successful traders and their profit percentage over time.

To begin copying, simply click ‘Follow’ on your chosen provider.

Charting

The platform makes use of price history charts from TradingView to help customers conduct their analysis and execute trades. It is also easy for clients to customize the experience through time frames ranging from 1 minute up to 1 day in addition to several charting types. This includes Heikin Ashi, Japanese candlesticks, bar charts, line charts and area charts.

Furthermore, IQCent has provided many in-built indicators to help with technical analysis, for example, relative strength index, average true range and the moving average exponential.

Extra Features

To improve the trading experience, IQCent also provides additional technical analysis and market insights. Here, you can read what experts from IQCent think about markets over the upcoming days and weeks. This includes resistance and support levels for certain securities.

Moreover, you can read about new trade ideas if you are thinking of adopting a new strategy. As well as analysis, there are tabs for recent news and an economic calendar populated with upcoming events such as countries releasing information on the inflation rate MoM and YoY.

Another benefit of using IQCent is the option to use various orders such as double up, rollover and sell out. Double up acts as a contract duplication service whereby you copy an open contract to enter a new trade with the same security, expiration and direction. However, the entry will be the current market value, not the value when you opened the initial contract. For example, if the initial entry price was $3 but the security is now trading at $3.50, the double-up contract entry will be $3.50.

The rollover feature allows you to extend the expiration time of an options contract. The first time you use rollover is a 100% increase in expiration time. For instance, if the contract is an hour, a rollover will extend expiration by another hour. All subsequent uses of rollover increase expiration by 30%. For example, an 18-minute increase for an hour-long contract.

To use rollover, your contract must meet certain criteria. Firstly, the contract must be out-of-the-money at the time of the request. Secondly, you must place the request before three-quarters of the contract time is complete (i.e. more than 15 minutes before expiry if the contract is one hour).

To use rollover you also have to stake an additional 30% deposit. For example, if you staked $100 to open the contract initially, you must invest another $30 to extend the expiry time.

Sell out is used to close a position before expiry. Note that this order is only available if your contract is currently in-the-money.

Account Types

There are three different live accounts:

Bronze

The most basic account type:

- Copy trading

- 20% deposit bonus

- Access to a demo account

Silver

All Bronze account features plus:

- 50% deposit bonus

- Three ‘risk-free’ trades

- Online training sessions

Gold

All Bronze and Silver account features plus:

- 100% deposit bonus

- Personal account manager

Demo Account

There is also a free demo account available to all IQCent users when they sign up and login.

The paper trading profile is a good way to practice using the proprietary platform before you start trading with real capital. It’s also a good place to start for beginners new to binary options trading and leveraged CFDs.

Account Verification

When you sign up to IQCent, you need to complete a ‘Know Your Customer’ process. KYC is used to verify accounts by having clients submit government-issued identification and proof of address. Only once you have completed the KYC process will you be allowed to make a withdrawal.

How To Verify Your IQCent Account

- Go to the ‘Personal Data’ section in Settings

- Input the identification document type

- Upload images of both the front and back of your chosen ID

- Sign the user agreement

IQCent Fees

IQCent does not charge commissions on binary options, meaning the payout available on the platform is the total turnover if the contract ends in-the-money. Payouts can reach 95%.

For CFDs, IQCent makes its money through spreads which start at 0.7 pips. Additionally, the broker charges a 0.07% swap fee on overnight positions. The only trades which incur a commission are cryptocurrency CFDs. For non-leveraged trades, the fee is between 1% and 2.5%. There is a fee of up to 5% when trading on margin.

There is also a $10 monthly inactivity fee.

Account Funding

There are a number of accepted deposit and withdrawal methods, including Visa and Mastercard debit and credit cards as well as cryptos such as Bitcoin, Ethereum and Tether. Regardless of the method, deposits are processed instantly and there is a minimum payment requirement of $250.

The expected withdrawal time is one hour, however, this may be longer if you submit the request outside of regular business hours. The minimum withdrawal amount is $20.

For transfers made using debit and credit cards, IQCent charges a 5% fee. If you use cryptocurrencies instead then deposits and withdrawals are free.

Note, withdrawals have to be made using the original deposit method. Additionally, withdrawal rules state that you must verify your account before you can request a payment.

How To Withdraw Money From IQCent

- Sign in to your account at https://www.iqcent.com/login

- Go to ‘Funds’ and click ‘Withdrawals’

- Select the method you used for your deposit and type your destination account details. For crypto transactions, this would be the wallet address

- Input the amount you would like to withdraw

- Confirm the request

If you experience withdrawal problems, contact the customer service help phone number found on the ‘Contact Us’ page. You should also check your account verification status as you may still be waiting for confirmation.

Regulation & Security

IQCent is not licensed by any regulatory authority, meaning your funds are not protected by any government schemes. The broker does, however, use 3D secure protocol and 256-bit SSL processing to encrypt user data.

IQCent Support

All accounts are entitled to 24/7 customer support. If you are experiencing issues such as the platform is down and keep crashing, keeps logging you out or features are not working, seek help. Additionally, if you want to delete your account, contact the customer service team.

The IQCent team can be reached through the following methods:

- Contact form via the website

- Email support@iqcent.com

- Social media accounts on Instagram and Twitter

- Phone numbers based in the USA, Russia, Singapore, Australia, Thailand and China

- There are several live streams running at any one time so you can speak to an expert while trading. They can offer helpful tutorials or guides on potential trading strategies

Apps & Accessibility

The primary IQCent trading platform can be accessed via a desktop web browser – there is no download option for PC.

Clients can also make trades using the mobile app. The application can be downloaded on iPhones and other iOS devices through the Apple App Store and on Android devices via the Google Play Store. You may also be able to find an unofficial alternative APK app through a third-party website online.

Bonuses & Promotions

IQCent runs various promotions and bonus schemes. When you first register an account, you are eligible to receive a deposit bonus that scales with how much you transfer. For example, if you deposit between the minimum limit and $999, the promo code will provide you with a 50% bonus. For deposits of $1,000, there is a 100% bonus.

IQCent also runs a weekly trading contest where clients compete to generate the greatest returns. The top 20 most successful traders are given cash prizes with the winner receiving $10,000, second place receiving $5,000 and third receiving $3,000.

Customers may also receive bonuses through referral schemes. Each account comes with a referral link to share with family, friends and colleagues. Bonus availability per referral is equal to 20% of the initial deposit.

Pros

Our experts found several benefits to trading with IQCent vs RaceOption and Videforex, for example:

- 100+ assets & markets

- 24/7 customer support

- $0.01 minimum trade size

- Binary options with 95% payouts

- Instant deposits and fast withdrawals

- Multiple promotions and bonus schemes

- Deposits and withdrawals using cryptocurrency

- Regular technical and fundamental analysis published

Cons

When we used IQCent, we also came across several drawbacks:

- Unregulated

- No MetaTrader 4 platform

- High minimum deposit of $250

- A short period before an inactivity fee is charged

IQCent Verdict

IQCent is an attractive broker due to its multiple markets, range of promo codes, copy trading services, and well-made trading platform. The technical and fundamental analysis reports are also a great aid for beginners looking to develop or try out new trading strategies. On the downside, traders are restricted to high/low binary options contracts in addition to CFDs. Also, the broker is not regulated by a trusted financial body.

Accepted Countries

IQCent accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use IQCent from United States.