Vantage Review

Overview

One of the leading online brokers based in Australia, Vantage offers a range of trading services, enabling clients to access the international forex market. Benefiting from award-winning customer care and with a commitment to delivering fast transactions, Vantage is a significant player in the online broker arena.

Vantage Company Details

Vantage (Formerly Vantage FX) is the representative of Vantage Global Prime Pty Ltd. The company was set up in 2009 under the name of MXT Global, before being rebranded in 2015.

Registered in Australia, the site was designed primarily for an Australian audience. The brand has since grown however, and now boasts a global user base.

This is reflected in the firm being regulated in Australia via ASIC, but also by the FCA in the United Kingdom, as well as with CIMA in the Cayman Islands.

Vantage Trading Platforms

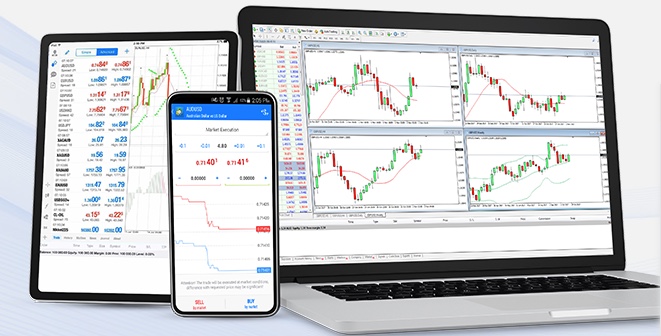

The site uses mainly MetaTrader software, giving users access to MT4 and MT5 as well as Markettrader, Webtrader (which doesn’t require a download), TradingView, apps for mobile trading, MAM/PAMM, Zulu trading and MyFXBook Autotrade.

The mobile app is available across platforms.

There is an emphasis on robot trading, where trades are made automatically within predetermined parameters.

The new MT5 platform enables many of the popular automated trading tools and add-ons made possible by the MetaTrader community.

Trading can be accessed either wholly online or through the 24/7/365 support team. They can be contacted by phone, email or live chat.

Overall the site is fast and fairly intuitive to use. Drop down tabs give easy access to the various features and markets available.

Vantage Assets & Markets

Traders on vantagemarkets.com are able to access 1000+ CFD instruments. This spans forex, indices, precious metals, soft commodities, energies, ETFs, and share CFDs. Cryptocurrencies can also be speculated on.

Vantage Spreads & Commission

Generally, Vantage is in line with most of the other key players in the online trading industry when it comes to spreads and commission rates. The Standard account does not attract a commission, but spreads are noticeably larger than those found in the Raw account (commission-based).

For the Standard account, an indicative spread of 1.4 (EUR/USD) is quoted. For the Raw account, forex spreads start from 0.0 pips, but commission is payable.

Demo and Islamic accounts are also available.

Leverage

For Vantage, leverage ratios start at 100:1, rising to a maximum of 500:1. Access to the higher levels of leverage is limited, with only some clients and accounts being eligible. Clients who wish to access higher levels of leverage need to apply directly to Vantage.

Ratios are broadly in line with what others are offering in the industry, but traders who prefer a higher risk approach may find the 100:1 restriction constricting on occasion.

Mobile Apps

The site gives users access to the official MetaTrader apps which are available in formats suitable for both Apple and Android devices. The apps allow traders to place forex trades and to see real-time prices in the same way as they can on a laptop or desktop computer.

Traders are able to edit pending orders through the app, which is synced with a trader’s other platforms to ensure seamless activity.

Deposit And Withdrawal Payment Options

Traders can deposit funds using: Mastercard; Visa; Swift; BPay; Skrill; Poli; Neteller. Funds deposited via a credit or debit card will normally be visible in the account and ready for use within sixty seconds. Bank wire transfer or BPay deposits will normally reach the account the day after they are deposited.

Withdrawals can be made either manually or online. Withdrawals are processed daily. In most cases, if the withdrawal request is received before 1200 AEST, the withdrawal will take place the same working day. For requests received after this time, or if the volume of requests is particularly high, the withdrawal will be processed the next working day.

For Australian clients, the funds should normally be in their bank accounts by the next working day. Overseas clients may have to wait several days for the money to reach their accounts.

Demo Account

A fully operation demo (practice) account option is available for forex trading.

Vantage Bonus Promotions

Vantage offers free education that covers the following topics: learn Forex; webinars; MT4 manuals; MT5 manuals; MT4 videos; MT4 smart trader videos.

In addition, traders can benefit from: the site’s Forex signals via email feature; tips to boost the trading account; trading signals; expert advisors; free Forex VPS; economic calendar; 50% welcome bonus; MT4 indicators; Forex sentiment indicators.

Vantage Regulation And Licensing

The company has a licence from ASIC, Australia’s regulatory agency for securities and investments. This is a trusted regulator and a good sign that the brokerage is legit. The company also holds a license with CIMA and the FCA.

Client funds are kept in segregated accounts.

Account Types

Besides being able to select between a dummy (practice) and a live account, traders may open an individual standard or RAW ECN account. Other account options include joint accounts, company trading accounts and Trust trading accounts (either as individuals or as a partnership).

In addition, there are also Islamic accounts (with no carryover) and Professional accounts, with increased leverage, but less regulatory protection.

Benefits

This site does have award-winning customer care, as well as an attractive set of promotions. It is particularly appealing to newer traders or those wishing to keep their levels of risk and investment at the lower end of the spectrum.

Drawbacks

Vantage doesn’t offer much added value for experienced traders or those wishing to adopt a higher risk strategy: experienced traders may find the upper limit of 1:100 leverage for most customers a burden.

Vantage Trading Hours

The site is open 24/7, with trading available when the relevant markets are open.

Contact Details

The support team can be contacted: by phone (1300 945 517); email: support@vantagefx.com; or live chat.

Safety and Security

The company operates a trader compensation scheme and has indemnity insurance. Clients’ funds are held in the National Australia Bank, in segregated accounts.

Is Vantage A Good Choice For Day Trading?

This is a reasonable platform for beginner traders or those who wish to trade relatively small amounts of money. Its additional partners (Zulutrade and ChartIQ) also provide added variety and value to traders.

The RAW account has an attractive rate of commission which can mean that it is more profitable to operate than the standard offering. Other than these features, there is little to distinguish it from many of the other trading sites which are available online.

More experienced traders may prefer to opt for a site which favours larger trades and a greater element of risk.

Accepted Countries

Vantage accepts traders from Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use Vantage from United States, Canada.